JUPITER, Florida – Father’s Day, the men’s U.S. Open and the kickoff of the summer golf season align to make mid-June one of golf’s most noteworthy annual windows for equipment sales.

So, as we run past the midpoint of 2023, what has the appetite for golf clubs and golf balls been like so far this year?

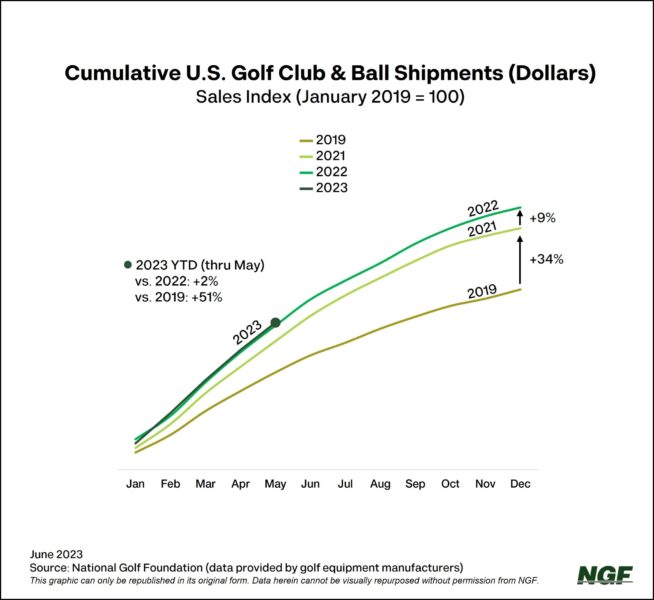

Here’s a snapshot from our aggregated Industry Sales Reports:

Cumulatively, ball and club sales are up 2% versus a year ago and still running 51% above our pre-pandemic base index (2019). While some of that is attributable to pricing increases, a byproduct of demand and rising costs (materials, research & development, shipping, labor, etc.), it speaks more to the sustainability of golf’s post-pandemic lift.

Entering June, golf club dollar shipments are down about 4% compared to the same mid-year stretch in 2022, while golf balls are up almost 18%.

Looking more broadly at the U.S. economy, it’s not surprising there are some limitations beyond consumables in the golf equipment market. This trend extends outside of golf, as McKinsey & Co. recently noted that high-income consumers’ spending growth was negative for the first time in more than two years. And that those with a household income of over $100,000 have reduced their spending more aggressively than lower-income groups have.

Retailers we’ve spoken to indicate that while club sales are flat or lagging just behind the same time a year ago, they continue to trend ahead of recent pre-pandemic years. And having ball sales ahead of, or on par with, last year’s pace is an indicator of continued elevated play levels.