This story was originally published by Golf Inc. magazine and is used here with its permission.

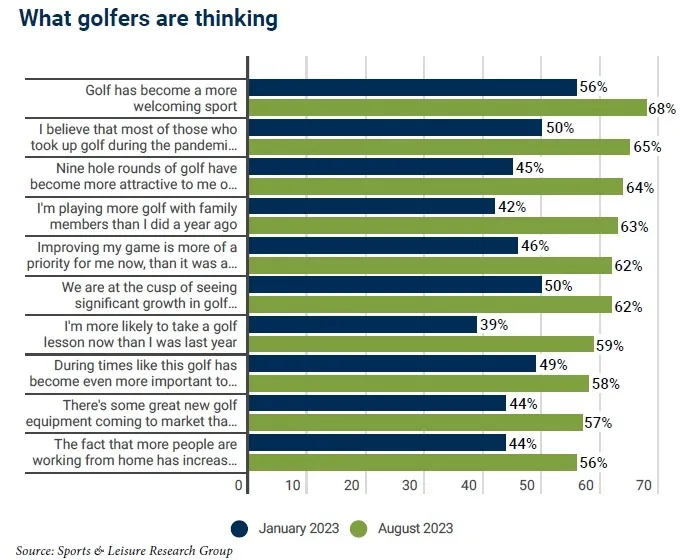

Golfers’ expectations are changing. They still want convenience and multiple options, as well as quality. But price is also becoming an issue. People are more budget conscious today than they were two years ago, according to a study by Sports & Leisure Research Group. And that’s affecting their decisions.

Jon Last, founder and president of Sports & Leisure Research Group, presented these findings at the Golf Inc. Summit in September. He was joined by Larry Hirsh, president of Golf Property Analysts, and John Pugliese, CEO of Landscapes Unlimited.

Golf memberships remain robust, Last said, but there are some cracks in the armor. The majority of private club members reported that their clubs are full and/or have waiting lists for new members. Most golfers remain bullish as the game continues to evolve, with 68% reporting that they are optimistic about the future of the game.

Overall, foundational changes remain top-of-mind for golfers, according to the survey. Issues include culture representation, short course play, playing with family members, improving their game with lessons, testing new equipment, and afford-ability.

“This is a great game that you can play all of your life,” Hirsh said. “But its culture is not always welcoming. Golf has not done a good job of getting away from elitism.”

Pugliese added that golf is still expensive, still hard and still time-consuming.

His company, Landscapes Unlimited, develops and constructs golf courses, country clubs and resorts globally. Its sister company, Landscapes Golf Management, operates more than 50 golf courses and country clubs nationwide.

“There is a reason they weren’t joining or playing before, and why they are now,” Pugliese said of the new surge of golfers. “Technology is probably the most expeditious way to find the commonalities.”

Club culture is also becoming a much more important business driver for golf facilities.

“Who does the club want to attract?” Hirsch said. “You can’t be all the things to all people. It’s important that [the club] understands where the opportunity is.”

Last agreed that measuring and defining the culture of your facility is a beneficial exercise.

“You need to independently understand the reputation of your facility,” he said.

And facility offerings are important to golfers.

Hirsh said it’s great to see many clubs finally addressing deferred maintenance.

“I’m all for that, but every club situation is different,” he said. “Clubs are now incurring excessive debt. What I’m advising my clients to do is that you need to develop plans that have ability to be phased in to generate revenues to pay for next set of improvements.”

Hirsch added that practice facilities are a critical part of any golf venue. Pugliese said it’s a balance of “want to and need to.”

“My best advice is to get a team together as fast as you can to help you understand those variables,” he said. “The genesis of that demand is different than in the past. Be honest with yourself about your staffing capabilities.”

In another recent survey, David Pierce, director of research for the USGA Green Section, and his team interviewed owners and operators to help identify what golfers are looking for.

Pierce and his team examined features of various clubs, including practice facilities, golfer-support personnel, scope of the golf shop, food & beverage offerings, event space and socializing options. The balance between golf and non-golf activities, along with the presence of lodging or global recognition, were also key considerations.

Facilities were divided into six categories. (See USGA Facility Segmentation box.)

“All golfer segments want excellent playing surfaces and pace of play, so improvements will increase golfer satisfaction and lead to increased revenue opportunities,” Pierce said.

Owners and operators who were interviewed said golfers at Lifestyle and Comprehensive facilities were more satisfied with course design, condition of the fairways, condition of greens and tees, and service than were golfers at Enhanced and Focused facilities, which provide fewer amenities.

The results showed that golfers at Enhanced facilities were more satisfied with service than golfers at Focused facilities. Golfers at Lifestyle facilities were more satisfied with pace of play than golfers from the three lesser categories.

“In general, the cost to play golf increases from Focused facilities to Lifestyle facilities — as do golfer expectations — so it is not surprising that overall satisfaction increases similarly,” Pierce said. “However, there are opportunities for improvement across all facility types for the pace of play and service.”

Pierce said that while different facilities have different maintenance budgets, “presentation of the golf course is the biggest differentiator of satisfaction and is only behind pace of play and ranger behavior in terms of the potential impact on golfer satisfaction.”

But there is cause for concern among operators regarding the rise in access fees. Pugliese, Last and Hirsch all said they are watching prices very closely.

“I’m concerned about price elasticity right now,” Hirsch said. “I’m concerned we’re going to repel the same groups we want to cater to. I think there is a point somewhere where people will resist.”

Besides rising fees and capital improvements, what is the most pressing issue that facility operators need to think about?

“It’s complacency,” Last said. “If you’re not evolving, you are dying.”

USGA Facility Segmentation

• Focused facilities deliver a golf course with minimal amenities.

• Enhanced facilities deliver a golf course with a driving range, some practice areas and limited on-course services such as a starter or ranger.

• Comprehensive facilities deliver a golf course with a driving range, full practice areas up to a complete learning center with player-support personnel present throughout the experience.

• Lifestyle facilities deliver everything a comprehensive facility would offer plus extensive socializing opportunities associated without golf are available.

• Resort facilities deliver a golf course with a driving range, full practice areas up to a full learning center with player-support personnel.

• Destination facilities offer experiences similar to any of the five previous categories and can be public or private.