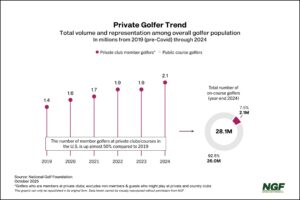

Golf is predominantly a public game in the U.S., with nearly three-quarters of courses open to all and less than 8% of the golfer population being members at private clubs.

But that 8% packs a serious economic punch, as private club golfers – at least generally speaking — play and spend more on the game, are more likely to take instruction or travel for golf, and have a higher average household income.

As a popular target market audience for many inside and outside the golf industry, it’s only natural we’re asked about this niche quite often.

With 2025 shaping up as potentially yet another record-setting year for rounds, it’s notable that private play is up +3% year-over-year versus +1% at public courses.

As a byproduct of that demand, it’s understandable our operator surveys reveal that private clubs that are more likely to suggest their facilities are closer to “capacity” in terms of how much play they can handle before it starts having a negative effect on operations.

This demand dynamic is a contributing factor when it comes to the slight uptick in development in the well-supplied U.S. golf market, as private clubs comprise a significantly higher proportion (more than 50%) of new course projects than they do among overall supply.