JUPITER, Florida — The economics of a golf course business flows from a simple but powerful principle: every tee time represents perishable inventory that, once lost, can never be recovered.

In golf, as with restaurants and other fixed-capacity businesses, this reality has two interlinked dimensions that we might consider.

First is the pure financials of unused capacity. When a tee time goes unfilled, the facility doesn’t just lose the green fee – it loses all the revenue accompaniments that would have come with it (food, drinks, range balls, hat, glove, etc.).

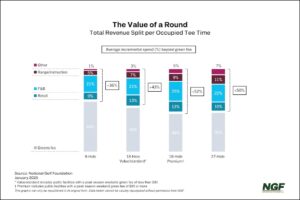

For the average 18-hole public facility, we estimate total revenue per occupied tee time (“RevPOTT”) to be roughly 45% above playing fees alone, which is perhaps a more significant lift than you might have guessed.

Consider, then, the impact of no-shows at golf courses. Recent analysis by an NGF Executive Member with visibility into more than 500 U.S. courses and 10 million rounds revealed a no-show rate of 9%, which would add up to about $1 billion in lost opportunity annually.

The scale of the issue is significant, and so is the sensitivity. Just as a restaurant can lose 5% of its income in one dinner service from a six-person no-show, golf facilities can see their margins eroded from only a few missed tee times.

The scale of the issue is significant, and so is the sensitivity. Just as a restaurant can lose 5% of its income in one dinner service from a six-person no-show, golf facilities can see their margins eroded from only a few missed tee times.

Even more striking is the extent to which lost inventory can be prevented – or at least addressed. The above-mentioned analysis determined that only 11% of abandoned rounds were due to unplayable conditions, meaning most no-shows can actually be curtailed through improved policies (e.g., requiring a credit card to book a tee time), communication (e.g., automated SMS reminders), and waitlist technology.

These tactics and more have helped the restaurant business mitigate the problem. In the aftermath of Covid shutdowns, OpenTable launched an educational campaign (“Show Up for Restaurants”) to illuminate the impact of unused reservations and late cancellations, as well as a tool allowing restaurants to identify ‘flight risks’ based on previous reservation activity, so that staff could be proactive about confirming attendance as the reservation approaches.

But managing inventory is only half the equation. The other dimension – a seemingly bigger opportunity – lies in reimagining how fixed-capacity businesses can unlock revenue potential across customer touchpoints.

As most hospitality businesses look for ways to drive revenue through integrated and elongated customer journeys – hotels transforming lobbies into social hubs, airlines creating premium experiences well before boarding, etc. – there are still many golf courses thinking narrowly and linearly (book time > play golf > leave), which only limits both customer satisfaction and business growth.

Even with the momentum of another record year for green grass rounds, forward-thinking operators are embracing transformation in a modern golf economy, including evolving driving ranges into tech-enabled destinations and elevating food and retail operations beyond basic conveniences.

But imagine other possibilities: a small side fleet of souped-up carts commanding luxury pricing, post-round contests with pro shop credit multipliers, pop-ups and partnerships with local businesses that create a more complete hospitality offering. These aren’t just add-ons – they’re paths to new revenue streams and a more personalized customer relationship.

The key shift is thinking like an experience designer instead of a golf operator, with each touchpoint presenting an opportunity to create value, rather than just facilitate the round.

Just as ancillaries have become a significant cornerstone of most hotels and airlines financial health, peripheral offerings in golf can protect against the vulnerability of perishable inventory while opening new avenues for growth. Success in an increasingly competitive leisure market will depend on operators who understand this dual opportunity.